In an increasingly digital world, the demand for quick and accessible financial solutions has surged. Quick Cash Loan Apps have emerged as a popular option for individuals seeking immediate funds to address urgent financial needs. These applications provide a streamlined process for obtaining loans, often with minimal paperwork and rapid approval times.

The convenience of having a loan at one’s fingertips has made these apps particularly appealing to those who may not have access to traditional banking services or who require funds outside of standard banking hours. The rise of Quick Cash Loan Apps can be attributed to several factors, including the growing gig economy, where many individuals work freelance or on short-term contracts, leading to fluctuating income streams. Additionally, unexpected expenses such as medical bills, car repairs, or emergency home repairs can arise at any moment, prompting the need for quick financial assistance.

As a result, these apps have become a lifeline for many, offering a solution that aligns with the fast-paced nature of modern life.

Key Takeaways

- Quick Cash Loan App provides fast and convenient access to short-term loans for individuals in need of quick money.

- Users can apply for a loan through the app by providing personal and financial information, and receive approval and funds within a short period of time.

- Eligibility for Quick Cash loans typically requires a minimum age, steady income, and a valid bank account, with no strict credit score requirements.

- Benefits of using Quick Cash include quick approval, easy application process, and flexibility in loan repayment options.

- Risks and considerations of Quick Cash loans include high interest rates, potential for debt accumulation, and the importance of responsible borrowing and repayment.

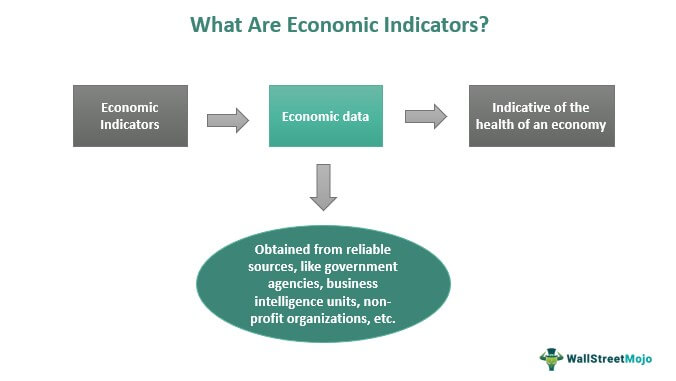

How Quick Cash Works

The operational mechanics of Quick Cash Loan Apps are designed to be user-friendly and efficient. Typically, users download the app onto their smartphones or tablets and create an account by providing personal information such as their name, address, and social security number. Once registered, users can apply for a loan by specifying the amount they need and the desired repayment period.

The app often employs algorithms to assess the applicant’s creditworthiness based on various factors, including income, employment status, and credit history. After submitting the application, users can expect a rapid response regarding their loan approval status. Many Quick Cash Loan Apps utilize automated systems that can process applications in real-time, allowing users to receive funds within minutes or hours of approval.

Once approved, the money is typically deposited directly into the user’s bank account, making it readily available for immediate use. This speed and efficiency are key selling points for these apps, as they cater to individuals who require urgent financial assistance without the lengthy processes associated with traditional lending institutions.

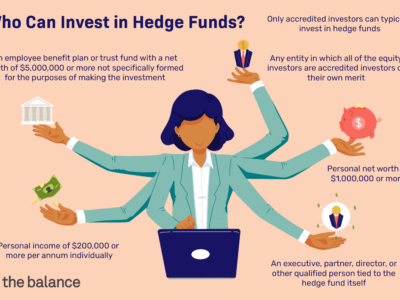

Eligibility and Requirements for Quick Cash Loans

Eligibility criteria for Quick Cash Loans can vary significantly from one app to another, but there are common requirements that most platforms adhere to. Generally, applicants must be at least 18 years old and a resident of the country where the app operates. Additionally, proof of income is often required to demonstrate the ability to repay the loan.

This can include pay stubs, bank statements, or other documentation that verifies employment and income levels. Credit history is another critical factor in determining eligibility. While some Quick Cash Loan Apps may offer loans to individuals with poor credit scores, others may have stricter requirements.

It is essential for potential borrowers to review the specific criteria of each app before applying. Furthermore, some apps may require users to link their bank accounts for verification purposes, which can expedite the approval process but also raises concerns about privacy and data security.

Benefits of Using Quick Cash for Fast Money

| Benefits of Using Quick Cash for Fast Money |

|---|

| 1. Quick access to funds |

| 2. Convenient application process |

| 3. Flexible repayment options |

| 4. No credit check required |

| 5. Can be used for various purposes |

One of the primary advantages of using Quick Cash Loan Apps is their speed and convenience. In situations where time is of the essence—such as medical emergencies or urgent home repairs—having access to funds within hours can be invaluable. Unlike traditional banks that may take days or even weeks to process loan applications, these apps are designed to provide immediate solutions.

Another significant benefit is the accessibility they offer to individuals who may not qualify for conventional loans due to poor credit history or lack of collateral. Quick Cash Loan Apps often have more lenient requirements, making it possible for a broader range of people to secure funding. This inclusivity can empower individuals who might otherwise be excluded from traditional financial systems, allowing them to address pressing financial needs without resorting to high-interest credit cards or predatory lending practices.

Risks and Considerations of Quick Cash Loans

Despite their advantages, Quick Cash Loans come with inherent risks that borrowers must carefully consider. One of the most pressing concerns is the high-interest rates associated with these loans. While they may provide immediate relief, the cost of borrowing can escalate quickly if not managed properly.

Borrowers may find themselves trapped in a cycle of debt if they are unable to repay the loan on time, leading to additional fees and interest charges. Moreover, the ease of access to these loans can encourage impulsive borrowing behavior. Individuals facing financial difficulties may be tempted to take out loans without fully understanding the terms or their ability to repay them.

This lack of financial literacy can result in long-term consequences that extend beyond the immediate need for cash. It is crucial for borrowers to approach Quick Cash Loans with caution and a clear understanding of their financial situation.

Tips for Using Quick Cash Responsibly

To mitigate the risks associated with Quick Cash Loans, borrowers should adopt responsible borrowing practices. First and foremost, it is essential to assess one’s financial situation thoroughly before applying for a loan. This includes evaluating income sources, existing debts, and monthly expenses to determine how much can realistically be borrowed and repaid without straining finances further.

Setting a budget is another critical step in responsible borrowing. By outlining a clear plan for how the borrowed funds will be used and establishing a repayment schedule, borrowers can avoid falling into debt traps. Additionally, it is advisable to read the terms and conditions of the loan carefully before signing any agreements.

Understanding interest rates, repayment timelines, and potential fees can help borrowers make informed decisions and avoid unpleasant surprises down the line.

Alternatives to Quick Cash for Fast Money

While Quick Cash Loan Apps offer a convenient solution for urgent financial needs, they are not the only option available. Individuals seeking fast money may also consider alternatives such as personal loans from credit unions or community banks, which often provide lower interest rates and more favorable terms than payday loans or cash advance apps. These institutions may also offer flexible repayment plans tailored to individual circumstances.

Another alternative is peer-to-peer lending platforms that connect borrowers directly with individual lenders willing to fund their loans. These platforms often have more lenient eligibility requirements than traditional banks while providing competitive interest rates. Additionally, individuals may explore options such as borrowing from friends or family members or utilizing credit cards with low-interest promotional offers as temporary solutions for urgent financial needs.

Is Quick Cash the Best Loan App for Fast Money?

In evaluating whether Quick Cash is the best loan app for fast money, it is essential to weigh its benefits against its risks and consider individual financial circumstances. For those who require immediate funds and have no other options available, Quick Cash Loan Apps can provide a valuable service by offering quick access to cash when needed most. However, potential borrowers must remain vigilant about understanding their obligations and ensuring they borrow responsibly.

Ultimately, while Quick Cash Loan Apps serve a specific purpose in today’s fast-paced financial landscape, they should be approached with caution and awareness of their limitations. Exploring alternative options and maintaining responsible borrowing habits can lead to better financial outcomes in the long run.

FAQs

What is a fast cash loan app?

A fast cash loan app is a mobile application that allows users to apply for and receive a short-term loan quickly and conveniently. These apps typically streamline the loan application process and provide fast approval and disbursement of funds.

How do fast cash loan apps work?

Users can download a fast cash loan app, create an account, and complete a loan application within the app. The app may require users to provide personal and financial information, as well as consent to a credit check. Once the application is submitted, the app’s algorithms quickly assess the user’s creditworthiness and determine loan eligibility. If approved, the funds are typically disbursed directly to the user’s bank account.

What are the eligibility requirements for fast cash loan apps?

Eligibility requirements for fast cash loan apps vary by provider but generally include being of legal age, having a steady income, and a valid bank account. Some apps may also require a minimum credit score or specific documentation to verify income and identity.

What are the typical loan terms for fast cash loan apps?

Fast cash loan apps typically offer short-term loans with repayment terms ranging from a few weeks to a few months. Loan amounts are usually smaller, ranging from a few hundred to a few thousand dollars. Interest rates and fees for these loans are often higher than traditional bank loans due to the convenience and speed of the application process.

What are the advantages of using a fast cash loan app?

The main advantages of using a fast cash loan app include the convenience of applying for a loan anytime and anywhere, fast approval and disbursement of funds, and a streamlined application process that may not require a visit to a physical bank or lender. Additionally, some fast cash loan apps may consider applicants with less-than-perfect credit.

What are the potential drawbacks of using a fast cash loan app?

Potential drawbacks of using a fast cash loan app include higher interest rates and fees compared to traditional bank loans, the risk of falling into a cycle of debt if the loan is not repaid on time, and the potential for predatory lending practices. It’s important for users to carefully review the terms and conditions of the loan and ensure they can afford the repayment before applying.